THE SELECTION STAGE

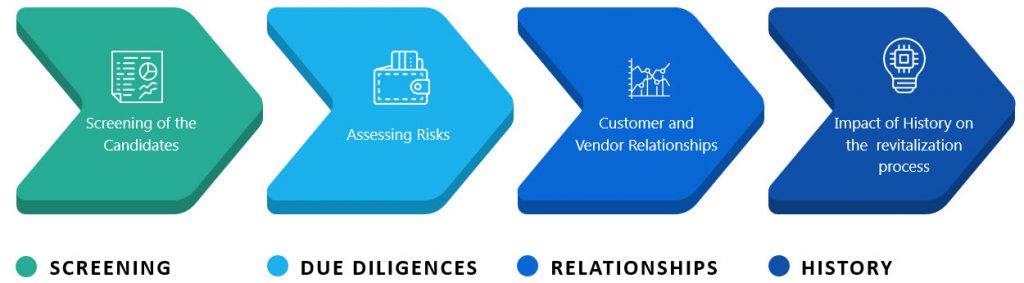

The first step in our process is to carefully screen identified candidates to determine their suitability that is consistent with the Gallamar Group’s experience, interests and criteria. Due diligence is required to both assess risk and ascertain the potential value of the companies we buy or invest in. This can often help prevent unexpected but perhaps foreseeable issues which might otherwise affect a target company’s chances for profitability.

Vendor status, customer relationships, management expertise, employee morale and other important concerns are key elements of our due diligence process. Overlooking any aspect of a thorough due diligence is almost always a recipe for disaster. As it relates to the distressed business, the Gallamar Group never assumes that the restructuring and revitalization process will simply erase a company’s prior history which has been well ingrained in the minds of suppliers, customers and the industry as a whole.

Vendor status, customer relationships, management expertise, employee morale and other important concerns are key elements of our due diligence process. Overlooking any aspect of a thorough due diligence is almost always a recipe for disaster. As it relates to the distressed business, the Gallamar Group never assumes that the restructuring and revitalization process will simply erase a company’s prior history which has been well ingrained in the minds of suppliers, customers and the industry as a whole.