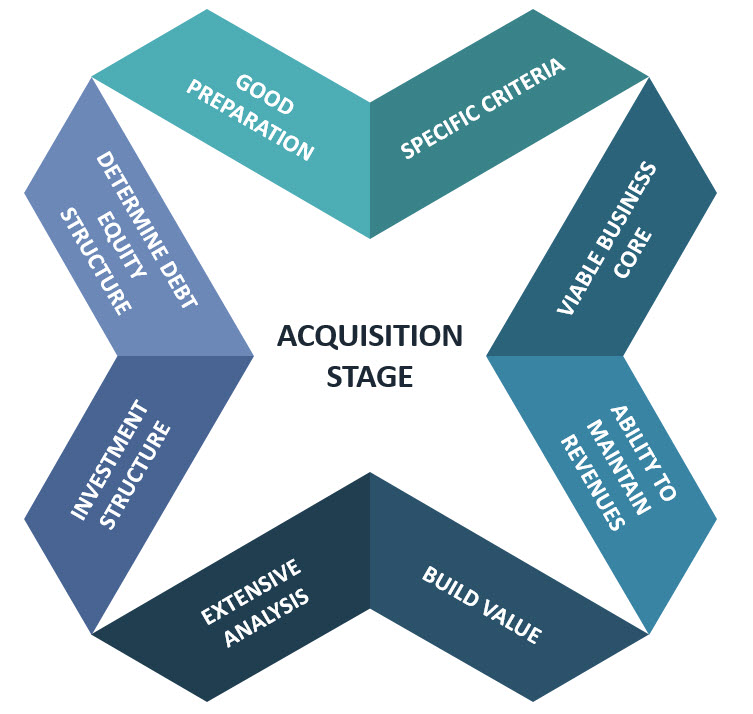

THE ACQUISITION STAGE

If the acquisition or investment in a distressed business is to be successful, it requires good preparation. The Gallamar Group has developed specific criteria used to evaluate our potential targets. We have strict policies concerning the kinds of companies we acquire with guidelines in place to filter out the unsuitable ones. One such consideration is the identification of a viable business core and the company’s ability to maintain sufficient revenues during the turnaround process.

Target companies which don’t meet our criteria are much more likely to underperform. They will undoubtedly take attention away from a company’s core business, requiring time-intensive “fixes” that a smoothly running company would not. The criteria we use to evaluate target companies are intended to ensure we have an excellent chance to turn the business around and build value.

In the event of an acquisition, financing is conducted simultaneously with the acquisition stage. Once the Gallamar Group and the seller(s) agree on price and terms, our principals have the responsibility for arranging and negotiating the necessary debt and equity financing.