THE GALLAMAR PROCESS

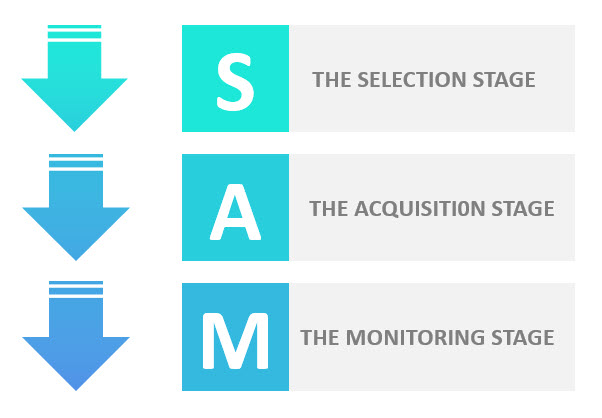

Acquiring a distressed company is a complex and risky undertaking which requires specific skills in all areas of operational reorganization, balance sheet restructuring, corporate finance and establishing sound management. The past success of our acquisitions can be accredited to the knowledge and experience of its principals, the unique structure of its acquisitions and the turnaround management skills of its operating partners. Each acquisition completed by the Gallamar Group is made by a newly created and organized entity. Our acquisition process is divided into three stages which we refer to as SAM:

The “Selection” stage includes defining, locating, screening, qualifying and evaluating the proposed acquisition investment. The “Acquisition” stage includes due diligence, investigation, pricing, structuring, financing, negotiating and closing. The “Monitoring” stage involves strategic planning, policy decisions, performance measurements, operational reforms and financial restructuring.